Forex Trading News Today: Key Updates and Market Insights

In the fast-paced world of forex trading, staying informed about the latest news is crucial for success. Every day, economic indicators, geopolitical events, and central bank decisions impact currency valuations around the globe. Today, we explore some of the most significant developments in the forex market and offer insights into how they might affect trading strategies. It’s essential to keep track of these changes and consider working with a reliable trading partner, such as forex trading news today Trading Broker UAE, for better market access and insights.

Market Overview

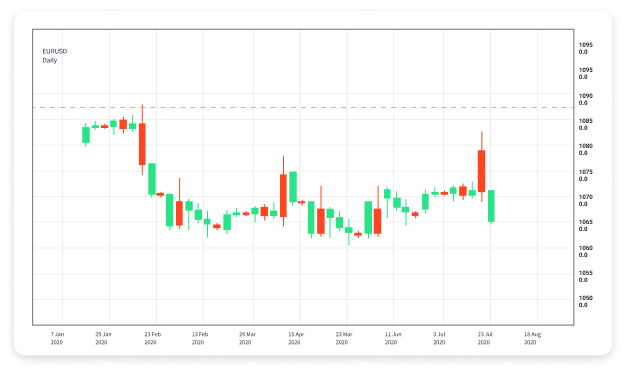

The forex market has seen significant fluctuations this week, driven by various factors ranging from economic reports to central bank interventions. Traders are advised to keep an eye on the major currency pairs, including EUR/USD, GBP/USD, and USD/JPY, as they continue to react to changing economic conditions.

Economic Data Releases

Recently released economic data has had a substantial impact on market directions. For instance, the U.S. Non-Farm Payrolls (NFP) report showed a robust increase in employment, which typically signals economic strength. As a result, the USD has strengthened against many currencies. Conversely, weaker-than-expected GDP growth in the Eurozone has caused the EUR to falter against the dollar and other currencies.

Geopolitical Events

Geopolitical tensions often create uncertainty and volatility in the forex market. For instance, recent developments in U.S.-China relations, including trade negotiations and diplomatic tensions, can lead to risk-off sentiment, prompting investors to seek safe-haven currencies like the USD and JPY. Moreover, geopolitical conflicts in various regions can affect global economic stability, thereby influencing currency strength and market predictions.

Central Bank Policies

Central banks play a pivotal role in forex trading. The Federal Reserve’s recent interest rate decisions have triggered widespread speculation about future rate hikes. Market analysts are closely monitoring signals from Fed officials regarding inflation management and employment goals. Similarly, the European Central Bank (ECB) is under pressure to respond to economic sluggishness, which could lead to changes in their monetary policy. Traders should be vigilant during central bank meetings and conference calls for potential impacts on currency valuations.

Technical Analysis

While fundamental news is critical, technical analysis cannot be overlooked. Today, many traders are evaluating support and resistance levels for key currency pairs. Chart patterns, moving averages, and indicators like the Relative Strength Index (RSI) are being utilized to assess market trends. Understanding technical analysis can provide traders with an edge, enabling them to make informed decisions based on market movements.

Trading Strategies

In light of current market conditions, several trading strategies can be effective. Swing trading, for example, allows traders to capitalize on price fluctuations over days or weeks, which can be beneficial in volatile markets. Day trading, on the other hand, involves making quick trades based on minute-by-minute changes, which can be risky but rewarding when executed with precision.

Risk Management

One of the most crucial aspects of forex trading is effective risk management. Traders should employ stop-loss orders to protect their investments and remain disciplined in their trading plans. It’s essential to assess risk-reward ratios before entering trades, and not to over-leverage, which could lead to significant losses during unpredictable market movements.

Conclusion

Today’s forex trading landscape is shaped by various economic, geopolitical, and technical factors that traders must navigate. By staying informed about the latest news and employing sound trading strategies, traders can position themselves for success. Remember to continuously reassess market conditions and consider collaboration with established trading partners, such as Trading Broker UAE, to enhance your trading experience.

As always, it is vital to remain adaptable and open to learning, as the forex market is constantly evolving. Regularly reviewing economic news, technical indicators, and geopolitical developments will help you make informed trading decisions.